Stellar Price Analysis: XLM/USD Trends of January 24–30, 2019

CoinSpeaker

Stellar Price Analysis: XLM/USD Trends of January 24–30, 2019

Key Highlights:

- The bears hold tight to Stellar market;

- XLM price is consolidating below $0.10 price level;

- the coin is trading below the two EMAs.

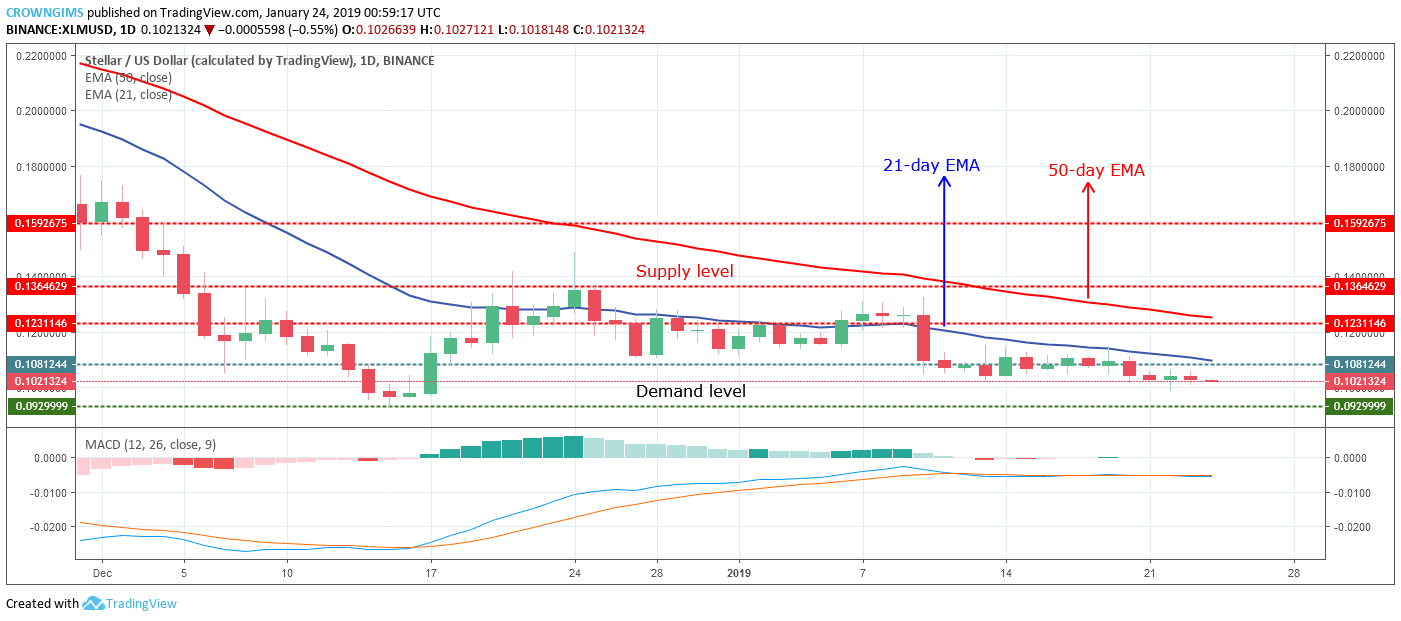

XLM/USD price Long-term Trend: Bearish

Supply levels: $0.10, $0.12, $0.13

Demand levels: $0.09, $0.06 $0.05 On the long-term outlook, XLM/USD is bearish. Early last week Stellar price was trading directly on the demand level of $0.10 with consolidation movement. Later, there was light increased pressure from the bears which brought about a slow downward push; that is the bears were able to break down the $0.10 demand level and consolidation began again below the $0.10 price level. The XLM price is currently facing the $0.09 demand level.

On the long-term outlook, XLM/USD is bearish. Early last week Stellar price was trading directly on the demand level of $0.10 with consolidation movement. Later, there was light increased pressure from the bears which brought about a slow downward push; that is the bears were able to break down the $0.10 demand level and consolidation began again below the $0.10 price level. The XLM price is currently facing the $0.09 demand level.

The bearish pressure is gradually increasing as the daily opening market candle is bearish and the coin is under the 21-day EMA while 50-day EMA is above the two which implies that the bears were still in control of the market. The MACD with its histogram is horizontally flat on the zero levels and its signal lines interlocked to each other flat, showing no direction which indicates that consolidation is ongoing and may continue for a while.

Further increase of the bears’ pressure may push the coin to its previous low and in case the bulls defend this level of $0.09 Stellar price may have its resistance at $0.13 price level.

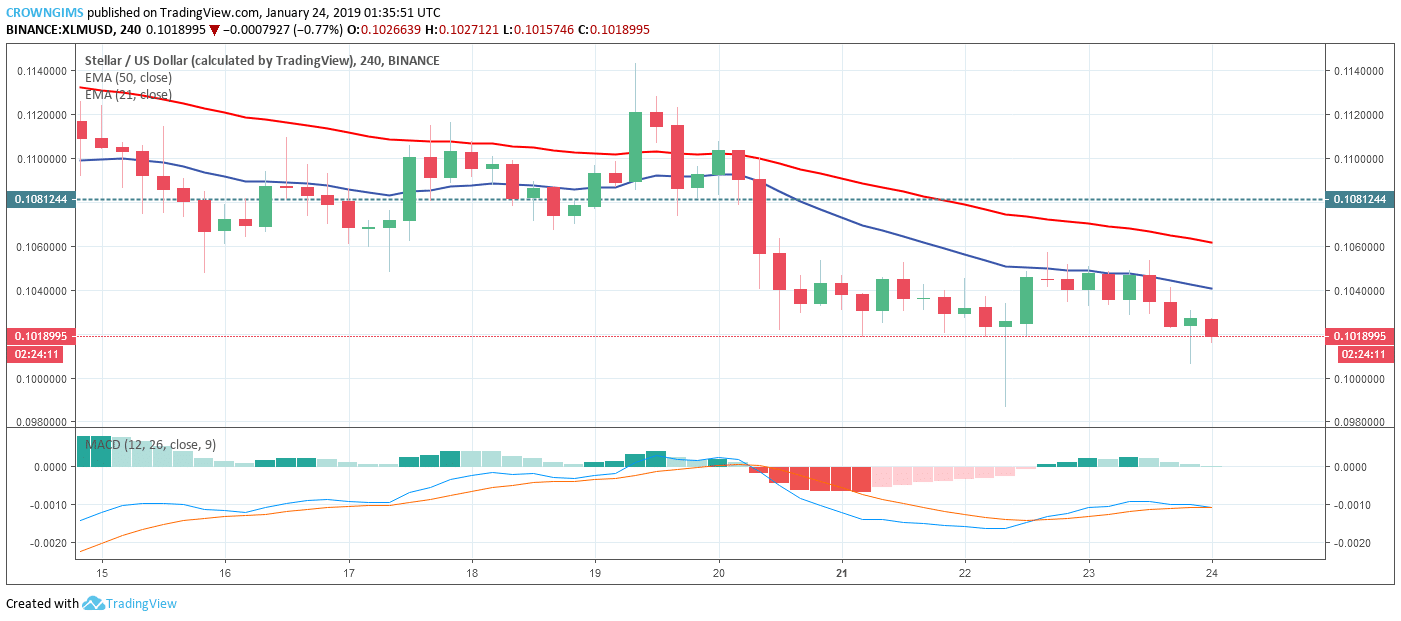

XLM/USD Price Medium-term Trend: Bearish

XLM/USD is equally on its bearish trend on the medium-term outlook. On January 19, the bull’s momentum pushed Stellar price far above $0.10 price level and moved towards the supply level of $0.12 but could not sustain the momentum and XLM price fell below $0.10 price level. The coin reached the low of $0.09 on January 22, further declination of the price was opposed by the bulls and the strong bearish candle turned to bullish pin bar.

XLM/USD is equally on its bearish trend on the medium-term outlook. On January 19, the bull’s momentum pushed Stellar price far above $0.10 price level and moved towards the supply level of $0.12 but could not sustain the momentum and XLM price fell below $0.10 price level. The coin reached the low of $0.09 on January 22, further declination of the price was opposed by the bulls and the strong bearish candle turned to bullish pin bar.

The MACD with its histogram above zero levels and its signal lines below zero levels bending downward indicates sell signal. The 50-day EMA remains above the 21-day EMA with the coin trading below the two EMAs as an indication of bears’ momentum in the Stellar market.

Stellar Price Analysis: XLM/USD Trends of January 24–30, 2019