Bakkt’s Upcoming Launch Just Might Be Why Bitcoin Sailed Past $10,000

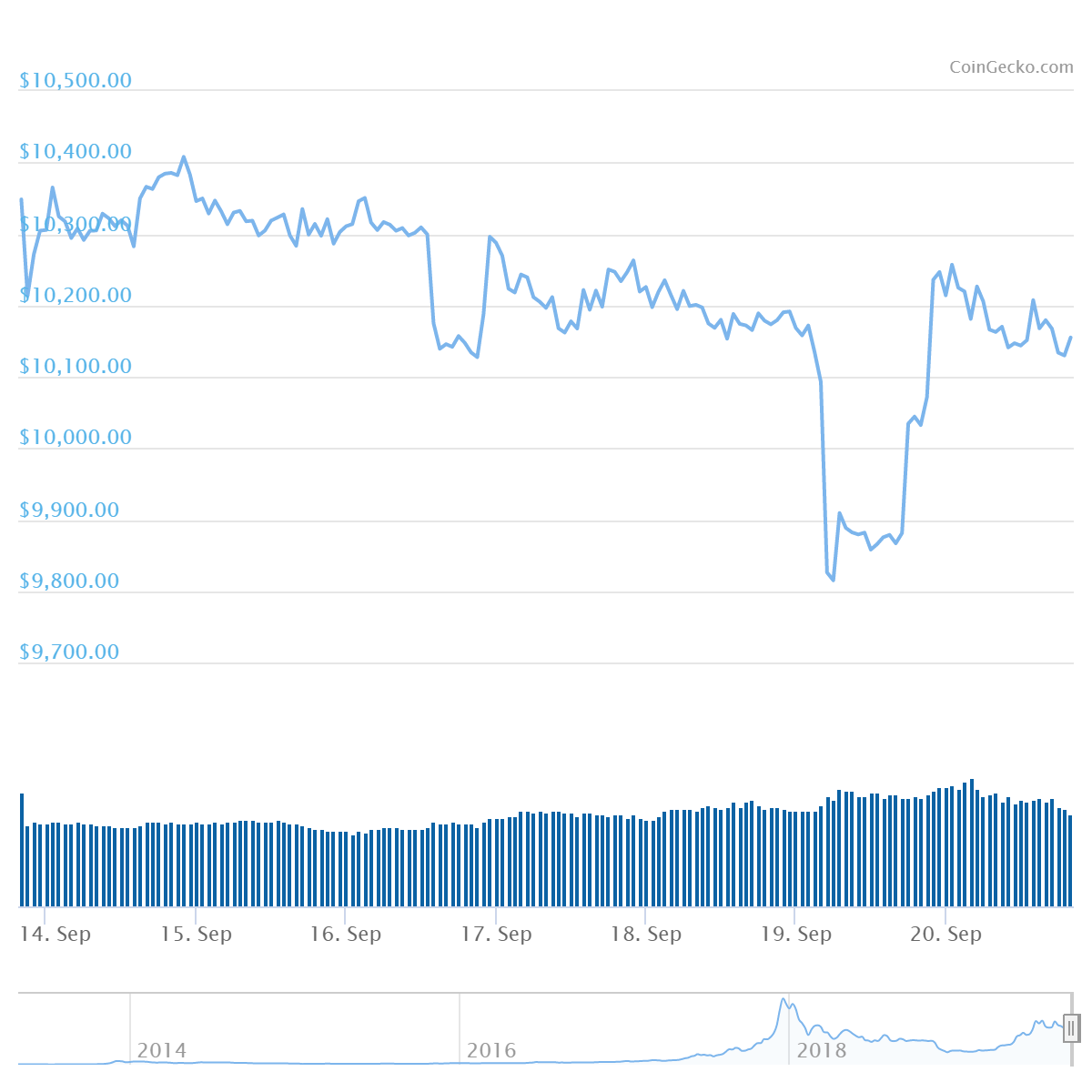

For a short while on Thursday, the bears seemed to be gaining some level of traction as Bitcoin lost more than $500, plummeting down below $9,600. However, the bulls seemed to take back control and the king coin quickly regained its balance in a few hours, gaining about $900 and crossing over the $10,000 mark.

Bitcoin then further went up above $10,400 and pulled back again. Regardless, this price movement in such a short timespan has led to the notion that Bitcoin just might be “preparing itself” for the Bakkt launch just a few days away.

One of the reasons Bitcoin may have fallen could be the market’s reaction to the Chicago Board Options Exchange’s (CBOE) decision to withdraw its VanEck/SolidX ETF application from the SEC.

The Commission is obligated to either approve or disapprove the proposal latest by October although it was already widely thought that the decision would be disapproved. The withdrawal seemed to corroborate the thought that there was no hope even on the CBOE side of the fence, causing the market to respond accordingly. This is the second time the VanEck/SolidX proposal would be withdrawn as it first happened in January this year.

However there are good tidings in the Bitcoin atmosphere as the Chicago Mercantile Exchange (CME) Group, just announced in a press release, that it will launch options trading for its Bitcoin contracts sometime in the first quarter of next year. The biggest clincher for Bitcoin, however, just might be Bakkt.

Expected to go live on Monday the 23rd of September, Bakkt was created to not only support the trade of digital assets but to also operate as the first service to actually deliver physically settled daily and monthly Bitcoin futures.

Since Bakkt has been fully approved by the U.S. Commodity Futures Trading Commission (CFTC), it has been suggested that institutional entities who have been reluctant to play in the largely unregulated crypto field, might now be a lot more willing to throw in their money.

In addition, there’s also something to be said for the fact that since Bakkt will settle in Bitcoin, (contracts have always been settled in cash) liquidity is bound to improve.

In some quarters, Bitcoin’s major resistance level has been set at $10,400, after which the king coin is expected to surge closer to $11,000. Will Bakkt be the much-needed catalyst for the Bitcoin rally the market is patiently waiting for?

The post Bakkt’s Upcoming Launch Just Might Be Why Bitcoin Sailed Past $10,000 appeared first on ZyCrypto.