Why The Plunging Exchange Withdrawals Value Indicates The Start Of An Exponential Bull Run For Bitcoin

While Bitcoin has been characterized by the lack of any volatility throughout the past two months, it is said to gain former shape in the nearest future. The clear indicator of it is the falling withdrawal rate, according to the CEO of the blockchain data firm, CryptoQuant.

A calculated approach to the next Bitcoin bull run

The analytical firm CEO Ki-Young Ju has published a metric that forecasts the start of the next bullish movement. It is grounded on the fact that the main driving force behind a significant upward movement in the interest of retail investors. So, once the BTC outflow (or withdrawal rate) on crypto exchanges becomes critically low, then Bitcoin enters a prosperity phase again.

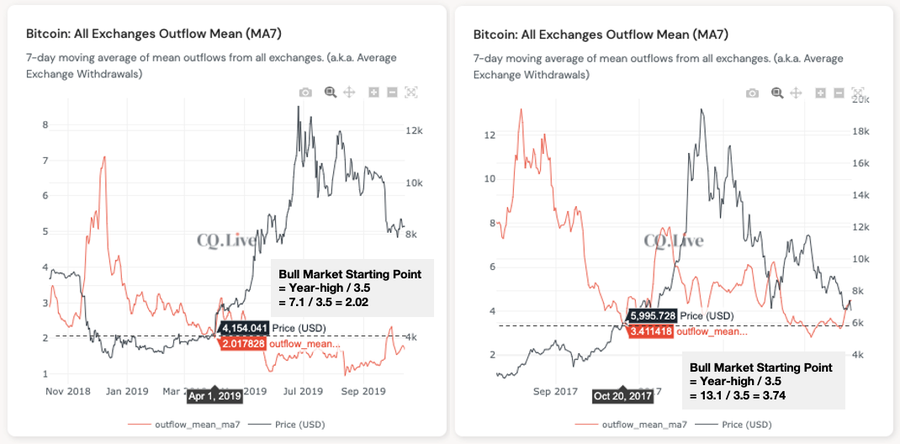

Based on historical evidence, CryptoQuant found out that the ‘golden ratio’ for this equation is 3.5, and the value of an all-time high price point that particular year should be divided onto it.

This principle in action is clearly illustrated in 2017 and 2019.

Taking into account the 2020’s highest price record which marked the beginning of summer, the current year’s infliction point is supposed to land at 2.97.

When will the bullish run materialize?

According to Ki Young Ju, he anticipates the outflow value point of 2.97 to arrive soon. While it’s still on the way, it is enough time to build speculations as to when this point will actually be touched.

The bitcoin outflow rate continues to slip down even further. However, this goes in the rather opposite direction with the fact that Bitcoin exchange balances have reached a record-low in the last few days. One possible explanation may be that investors prefer holding cryptos in cold wallets, while nevertheless favoring Bitcoin as their long-term investment asset.

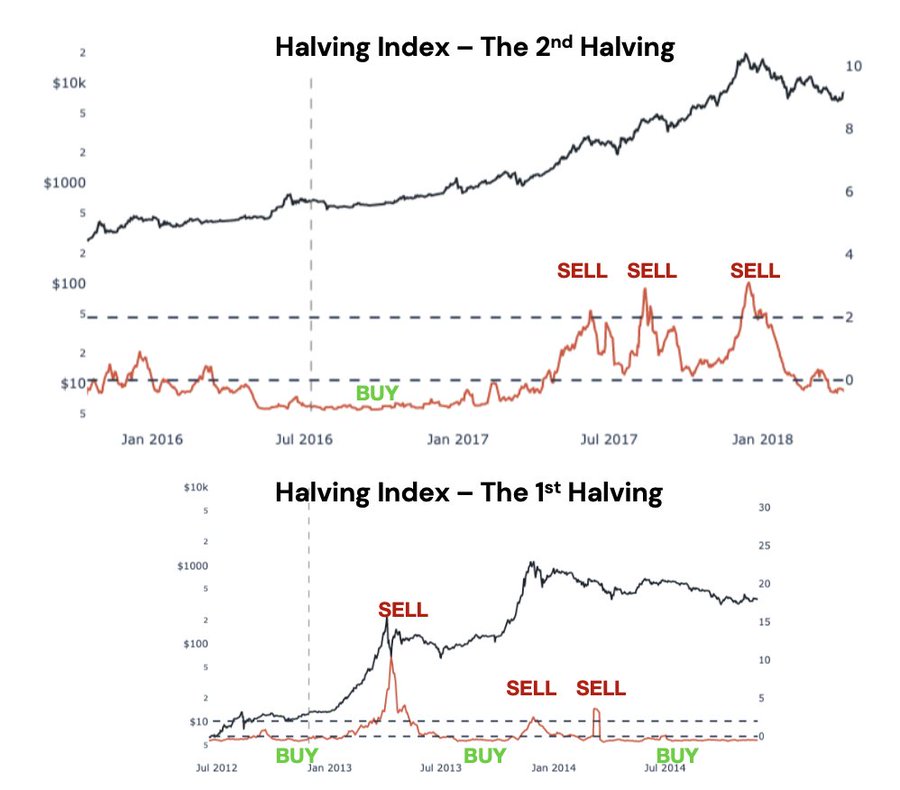

Ki-Young Ju considers that miners play a crucial role when defining the price of a digital asset. MPI – a Miner’s Position Index – suggests whether miners are holding their position in BTC or withdrawing it.

The past data suggests that miners opt for selling their coins only a few months after the halving event. Clearly, the miner activity could be a signal to follow in order to predict Bitcoin’s next likely move.