Fmr Goldman Sachs Exec “Struggles” Not to Sell His Bitcoin For Ethereum

With a 7% increase over the past day and a 53.4% in the monthly chart, Ethereum trades at $2.636,08 and seems to be leading this alt season. Former Goldman Sachs executive, Raoul Pal, has shared data to demonstrate the bullish case is real and ETH’s potential to push into uncharted territory for the rest of 2021.

Up 10% against Bitcoin (BTC), ETH operates as the cryptocurrency to price “anything up in DeFi, NFT, community tokens or even metaverse world”, said Pal. Most of the crypto space’s current trends are based on Ethereum and seem to be blooming. In particular, DeFi has seen impressive growth.

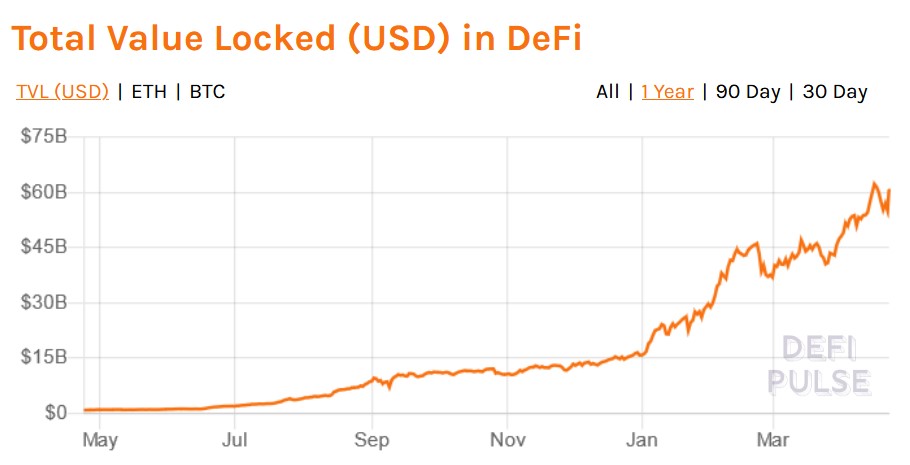

Data from DeFi Pulse shows this sector reached an all-time high in Total Value Locked (TVL) on April 15th, when it reached $62 billion. Although it registered a small decline over the past week, this metric stands at $60.01 billion with its top 3 DeFi protocols (MakerDAO, Compound, Uniswap) with a TVL of over $24 billion. Pal said:

ETH is rapidly becoming the currency of the digital world and BTC is the pristine collateral and base layer.

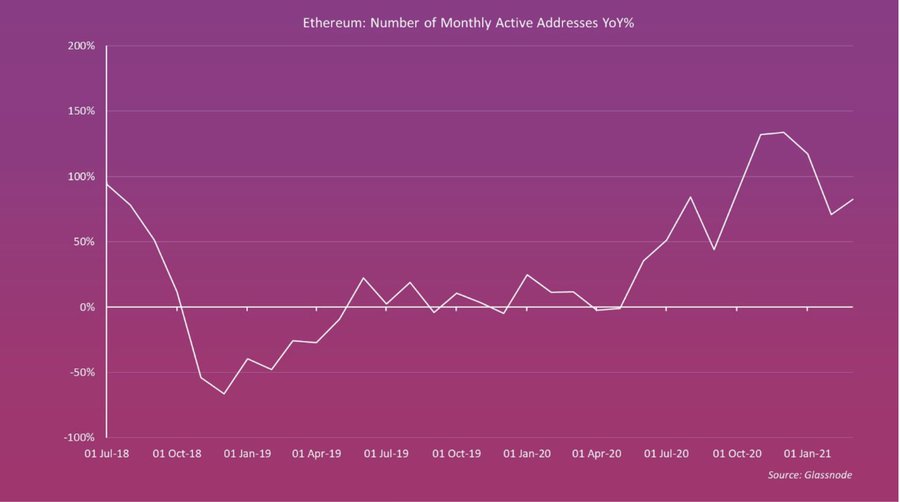

The former Goldman Sachs executive added that ETH space registered a 100% Year on Year (YoY) growth, as seen in the chart below. In contrast, BTC’s YoY growth stands at 50%. Also, Ethereum has been “attracting a massive proportion of the developer talent and applications”.

Ethereum dominates in BTC/ETH pair

Back to the BTC/ETH pair chart for the past 3 years, Pal believes ETH has reached “an enormous, rounded bottom”. In a previous analysis, Pal said ETH has outperformed BTC by 250% since 2015 when the former cryptocurrency was launched. Ethereum has a network effect capable of providing this token with a sustained rally in BTC terms, Pal added.

As a bonus, ETH 2.0 will improve the platform’s scalability, fee cost, and reduce the supply of the cryptocurrency. Raoul Pal said:

At this point in the risk cycle and with ETH 2.0 coming (cheaper fees and less supply), I’m struggling to not sell all my BTC to move my entire core position to ETH. To be clear – I’m a massive BTC bull, but I think ETH is the better asset allocation for performance right now.

At the time of writing, ETH is breaking ATH barriers and continues to pump in the daily chart. In terms of market cap, ETH is close to surpassing PayPal’s. The cryptocurrency’s market cap stands at $304 billion. As analyst Ali Martinez noted, there has been a significant spike in the number of whales active in Ethereum’s network.

After the weekend flash crash, investors with over 10,000 and 100,000 ETH saw an important rise. Therefore, Whales bought the dip and increased ETH buying pressure leading to the current price action. In response to Pal’s argument, trader Peter Brandt said: “Raoul, I see it the same way”.