Crypto Prices Consolidate, Analysts Blame Bitcoin Market Rout on ‘Overleveraged Positions’

Digital currency markets have been consolidating after taking some heavy losses during the last few days. Billions of dollars have jumped back into the crypto economy on Thursday, as the overall market valuation of all coins in existence has jumped back to $1.75 trillion on Friday. Bitcoin is resting above the $40k handle but the leading crypto is still down 17% during the last seven days.

Crypto Market Enter Consolidation Phase, Technical Analysis Shows Oscillators and Moving Averages ‘Neutral’ to ‘Strong Sell’

Bitcoin and a number of digital currency markets have been healing and consolidating after taking some deep losses during the course of the last week. Currently, bitcoin (BTC) is down 3% during the past 24 hours and down 17% for the week. Reported volume on Friday shows around $71 billion in global trades, but Messari.io’s ‘real volume’ stats show BTC volume is really around $19.2 billion.

The largest trading pair with bitcoin (BTC) today is tether (USDT) as it captures 51% of all trades on Friday. This is followed by the USD (19.58%), BUSD (7.04%), JPY (6.42%), EUR (5.68%), and KRW (2.51%). USDC (2.1%) and GBP (1.7%) are just below the top trading pairs with BTC this week.

So we're just all gonna act like yesterday never happened, right? pic.twitter.com/jCsHiWHnMR

— Depression BTC (@depression2019) May 21, 2021

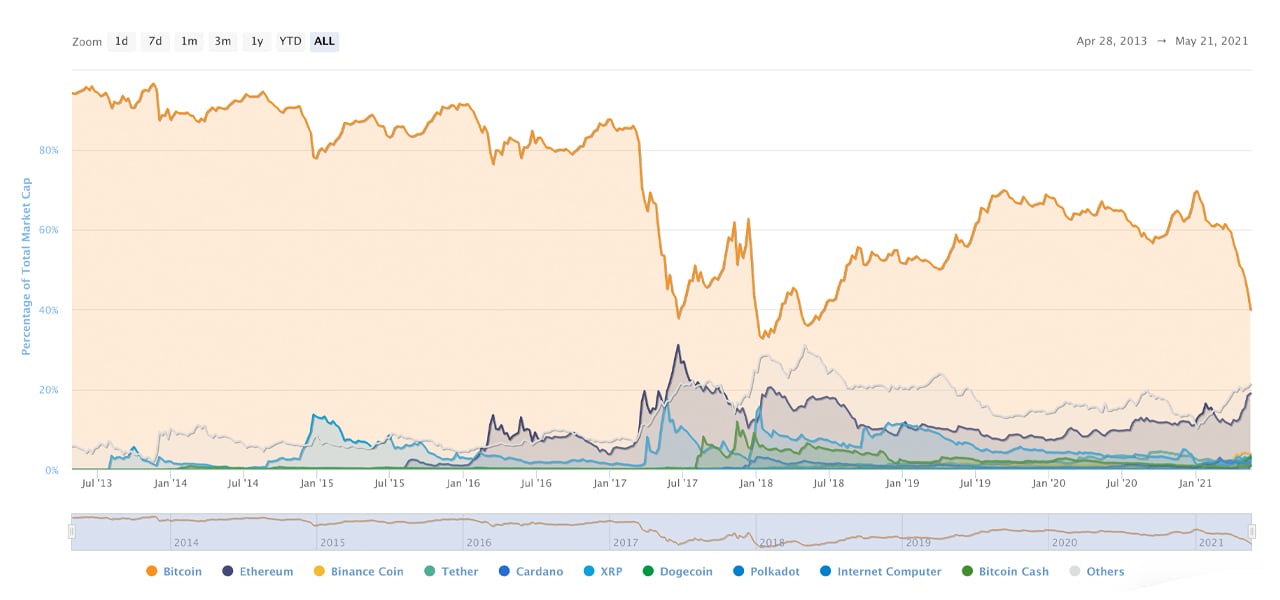

Meanwhile, BTC dominance has increased since dropping to a low of 41% earlier in the week. At press time BTC dominance is hovering at around 43.3% while ethereum (ETH) is down to 17.7% today.

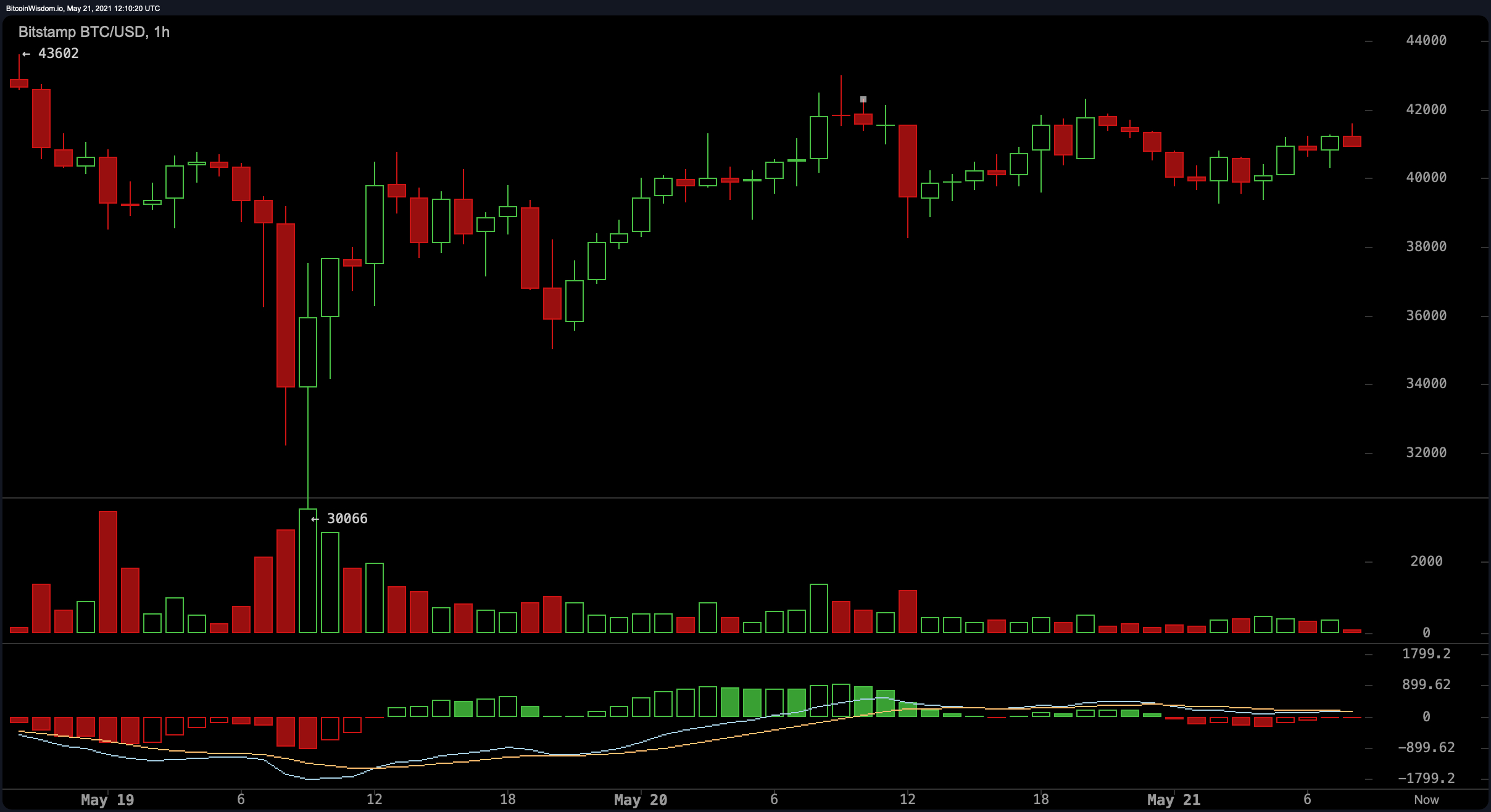

Looking at the 4-hour BTC/USD chart stemming from Bitstamp shows most oscillators and moving averages are either signaling neutral or strong sell sentiment. The Relative Strength Index (RSI) is impartial at ~33.11 and Stochastic is nonpartisan as well at 31.63. The two Simple Moving Averages (SMA 100-200) show the short-term SMA 100 dipped below the SMA 200 trendline. This indicates that the path toward the least resistance is currently the downside and bulls seem to be slowing down after meeting stronger hindrances these last few days. Although, the momentum oscillator MACd suggests a stronger buy signal and some more improvement is on the cards going forward.

Analysts Claim Overlevereged Markets Pulled Crypto Prices Down, ‘Most of the Leverage Is Out of the System Now’ Says Delta Exchange CEO

In a note sent to Bitcoin.com News on Friday, Anatoly Crachilov, the cofounder and CEO of Nickel Digital explained that overleveraged positions catapulted the deep losses last week.

“In April, bitcoin’s valuation hit an all-time high, delivering 122% gain from the beginning of the year, while ethereum has demonstrated an even more impressive run of 479%,” Crachilov said. “This rally attracted billions of dollars of both institutional and retail capital. While the former often comes in the form of portfolio allocations, the latter is often driven by speculative considerations, in most cases with the use of significant leverage,” the Nickel Digital executive added. Crachilov further said:

These overleveraged positions bring vulnerability to the market, making it excessively sensitive to negative news flow. A combination of statements coming from Vitalik Buterin, Elon Musk, and Chinese authorities in a space of a week was sufficient to trigger a market correction. This was exacerbated by a cascade of auto liquidations of overleveraged positions on crypto exchanges, which amounted to over $9 billion in 24 hours, one of the largest volumes of liquidations ever.

Alongside Crachilov’s commentary, Delta Exchange CEO Pankaj Balani also spoke to Bitcoin.com News to share his insights. Balani is a UBS alumnus that gained financial, derivatives, and quantitative financial experience through his positions at Edelweiss Asset Management and Elara Capital. Balani’s market insight also discussed the overleveraged positions that were liquidated this week.

“The sharp move in BTC on Wednesday was due to massive liquidations. We had pointed out in our previous weekly newsletter that Bitcoin had lost momentum and was looking weak,” Balani wrote on Friday. “There was too much leverage in the system (evident from 40%+ annual premium on bitcoin futures) and as the price started to slip these levered longs went into liquidations. Congestion on chains, downtime on exchanges etc. further added fuel to the fire as traders were not able to furnish margins on time and a cascading effect pushed the price lower.”

Balani further added that his team believes that most of the leverage is out of the system now and bitcoin should start to form a foundation here. “However, the sharp fall – 40% between Sunday & Wednesday – has eroded confidence and it will take some time for BTC to regain upward momentum. Bitcoin wiped out the bulk of its gains for YTD,” Balani stressed. The Delta Exchange CEO added:

The bounce has been sharp and it looks like the bottom is in but the price action till the end of the month is going to be critical. The $36,000 level has acted as good support here. A conclusive break below that would signal that this correction is bigger than a short-term bull market pull-back and all bets are off.

What do you think about today’s crypto market action and recent bitcoin prices? Let us know what you think about this subject in the comments section below.