What Does Coinbene Rely On to Function in Extreme Market Conditions?

Coinspeaker

What Does Coinbene Rely On to Function in Extreme Market Conditions?

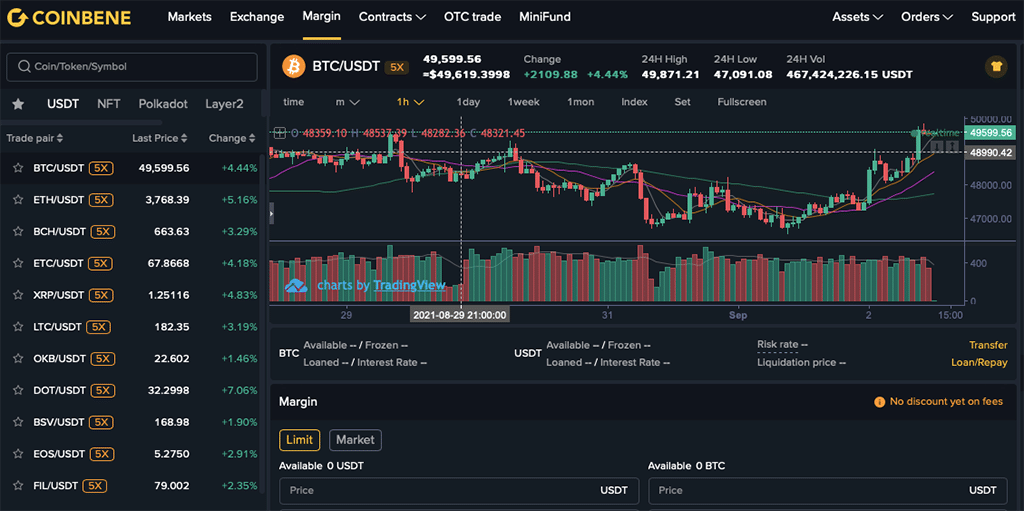

Sharp rises and falls are common in the cryptocurrency world. Like on the night of 19 May, when cryptocurrencies plummeted across the board at an accelerating rate. Coinbene recorded a 30% fall below $29,000.00 in Bitcoin prices within 24 hours, hitting a new low since the end of January this year; Ether lost over 50% of its valuation and dipped below the $1,700 mark, do; Dogecoin lost $0.2 per coin, down over 60% in a day.

Spot traders are not the worst off in this case. They at least have their coins in their possession after the plunge. It is a completely different story for the contract traders as exchanges experienced prolonged downtime with prices bottoming and currencies that can’t be sold. Investors can only watch as their positions implode, causing heavy losses. At that time, Coinbene continued operating, a testament to its system’s stability, with no downtime experienced even as our exchange saw a huge spike in the number of transactions transacted on our platform. This prevented many unnecessary losses.

The fact that Coinbene emerged from the industry-wide outage unscathed was a blinding testimony to the platform’s foundational robustness. This became a hot topic in the crypto community, have stood out heads and shoulders from the rest. Some users also ridiculed the idea, pointing out that this was the case as the project had smaller traffic which was patently ridiculous as second and third-tier exchanges have also experienced downtime.

Coinbene has always placed great emphasis on its security, protecting their user assets with cutting-edge technology.

What is the reason why Coinbene was able to survive this industry-wide downtime?

- Security first, Coinbene employs enterprise-level protection

Data has shown that since its inception, Coinbene has resisted wave after wave of hacking attempts. Coinbene has secured strategic partnerships with many security institutions at home and abroad, engaging cutting-edge security protection in HSM banking. The platform was rated five stars after the Bitforest and TokenInsight professional security test of our systems. Our low-latency, highly resilient and scalable Millennium aggregation engine technology provides institutional-grade transaction performance and reliability, allowing everyone to trade digital assets safely and securely.

CoinBene has attached great importance to the security of the platform since its establishment. As CoinBene’s CEO Uelington de Nascimento often said, “We are responsible for the transactions of users. The trading platform should assume the responsibility of protecting user assets, and we do not consider the cost of the investment in security.”

- System stability

Many exchanges experienced downtime on the 19th of May caused by a surge in traffic. Coinbene utilizes not only AWS, but also Alicloud servers in Hong Kong. Generally speaking, the stability of system services is rated by security agencies and if the system achieves a score of 99.99%, it is considered to have met the standards. This means that Coinbene’s annual system downtime is less than 50 minutes.

- Evolving platform upgrades

For example, the Coinbene contract trading function uses a market pricing mechanism that involves an averaging mechanism that is used in its calculation. This mechanism can smoothly filter out contract price fluctuations within a short period of time, effectively reducing unnecessarily forced position closures arising from abnormal fluctuations in the market. The latest upgrade to the underlying trading system has reduced latency with an instantaneous transaction capacity of over 1 million transactions per minute. This is a significant improvement in stability and concurrent capacity compared to the previous version. It ensures that Coinbene users do not suffer from platform lag that leads to position routs during extreme market conditions.

- Insurance

Coinbene will always prioritize security and platform stability for our users. However, there may be force majeure incidences that take this control out of our hands. As such, the assets can be insured to the tune of 10,000,000.00 USDT. Claims are administered in 24 hours with a 100% payout rate.

All in all: extreme volatile markets are the most suitable for trading with Coinbene’s contracts. Coinbene’s product and technological advantages, accumulated over years of experience, are also sufficient to provide users with a better trading experience and a much more stable trading environment.

What Does Coinbene Rely On to Function in Extreme Market Conditions?