Satoshi’s Math: How Bitcoin’s Use of Mathematical Tools Ensures System Consistency

Over 14 years ago, Satoshi Nakamoto unveiled the Bitcoin network to the world, creating the very first triple-entry bookkeeping system known to mankind. This technological wonder, with a current market value of $540 billion, ingeniously integrates encryption and mathematical formulas to fortify its security. In this exploration, we delve into two of the mathematical choices that underpin Bitcoin’s complex architecture, determining block rewards, transaction inputs and outputs, and mining difficulty adjustments, while also regulating the pace at which new blocks are discovered.

Whole Numbers at Work: A Look at Bitcoin’s Use of Integers

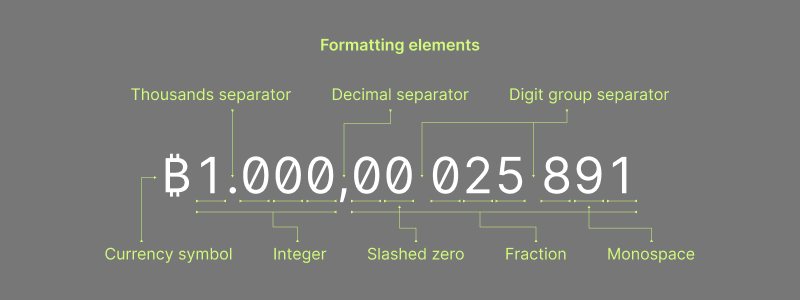

Bitcoin was created using a variety of encryption processes and mathematical formulas, each with a specific purpose. One design element incorporated into Bitcoin is the use of integers, or whole numbers and their negative counterparts.

The Bitcoin network utilizes integer math to prevent potential disagreements that could arise if decimal or fractional numbers were used. The use of whole numbers and their negative counterparts ensures that all computational devices can synchronize more effectively and agree on specific network changes.

The use of integers to maintain Bitcoin’s ruleset includes block rewards and halvings that occur at specific block heights divisible by 210,000. Bitcoin’s mining difficulty also utilizes integers to adjust the difficulty every 2,016 blocks. Integers, a type of numerical data frequently used in computational software, are also employed in Bitcoin transaction inputs and outputs.

Furthermore, integer calculations are generally faster and less prone to error than floating-point numbers. If Bitcoin were to use floating-point numbers, it could introduce rounding errors, leading to inconsistencies and disagreements between different nodes on the network.

Since Bitcoin uses integers, the block reward from a future halving will eventually be truncated or rounded down to the nearest whole number using bit-shift operators or a bitwise operation. Because the smallest unit of Bitcoin is a satoshi, it makes it impossible to halve. As a result, Bitcoin’s much-discussed capped supply of bitcoin will actually be less than 21 million.

Regulating Block Times with Poisson Distribution

In addition to integers, Bitcoin employs a Poisson distribution-like mathematical formula to regulate block time consistency. The Poisson distribution model was developed in 1837 by French mathematician Simeon Denis Poisson. Using this model, Bitcoin’s design ensures that blocks are discovered every 10 minutes or so.

The actual time it takes to mine a block can vary due to the probabilistic nature of the mining process, but blocks are typically found within the range of 8 to 12 minutes. Satoshi incorporated a difficulty setting every 2,016 blocks using the formula to maintain the rough average of 10-minute block intervals.

Both integer math and Poisson distribution are essential mathematical tools in Bitcoin, providing a consistent framework for performing calculations and modeling various aspects of the system.

Bitcoin employs numerous other mathematical mechanisms and encryption schemes to ensure accuracy, consistency, and efficiency of the system as a whole. These include concepts and formulas such as proof-of-work (PoW), Merkle trees, elliptic curve cryptography, cryptographic hash functions, and finite fields, among others.

What do you think about the mathematical schemes used by the Bitcoin network? Let us know your thoughts in the comments section below.