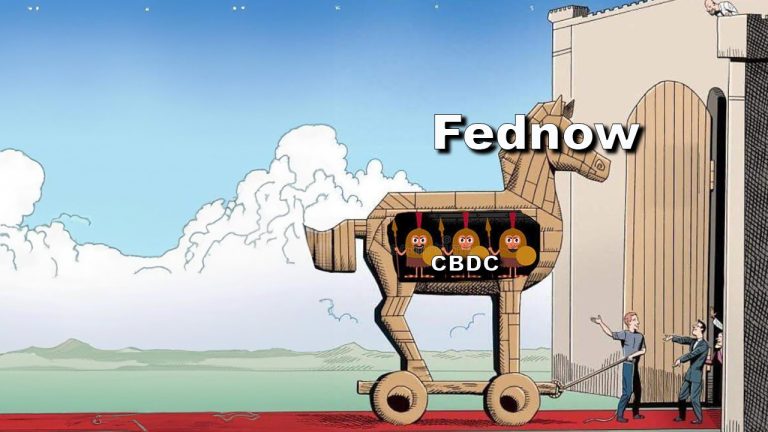

Is Fednow the First Step Towards a Central Bank Digital Currency? Speculations Rise Ahead of Launch

In recent days, there has been a buzz surrounding the upcoming debut of the U.S. Federal Reserve’s Fednow project, slated for July 1, 2023. The discussions surrounding this topic have sparked speculation about whether this marks the central bank’s inaugural foray into a central bank digital currency (CBDC), with some suggesting that Fednow may render blockchain-based cryptocurrencies obsolete.

Fednow System Launch Ignites CBDC Speculation

The highly anticipated Fednow system is set to launch on July 1. Developed by the U.S. Federal Reserve, this payment system aims to provide “24x7x365 settlement service” and facilitate instantaneous payments. Extensive information on this subject has been released by the Fed, with significant involvement from the U.S. Treasury. The Federal Reserve’s board members have conducted an evaluation and determined that the central bank is “well positioned” to tackle the nationwide implementation of instant payment infrastructure. It is worth noting that although Fednow offers immediate settlements, it does not adopt the blockchain-based approach.

FedNow is looking more and more like a retail CBDC everyday. pic.twitter.com/0PZ2Hjx8U2

— Luke Mikic⚡️🇸🇻🇦🇺 9-5 Escape Artist (@LukeMikic21) June 21, 2023

The Fednow system utilizes ISO 20022, a worldwide standard for electronic message exchange between financial institutions established in 2004. ISO 20022 is widely employed by SWIFT, numerous financial organizations, and financial services. Its predecessor was ISO 15022. The ISO 20022 system adopted by the Fednow project functions as a shared financial language, enabling different banks, financial institutions, and systems to comprehend and exchange settlement information. It should be noted that the ISO 20022 system does not maintain a ledger for recording these settlements. Instead, relevant information is recorded and stored in databases or systems specific to the financial institution or organization involved.

FedNow may be a psyop for a US based CBDC.

Seems likely.— Jason A. Williams (@GoingParabolic) June 26, 2023

Amidst conjecture and speculation, there are discussions about the potential evolution of a central bank digital currency (CBDC) from the Fednow system. However, in its current state, the infrastructure of Fednow is essentially comparable to the conventional payment rails utilized by existing financial incumbents. Is it possible for a CBDC to supplant it? Certainly, any system, including the Fednow and its underlying infrastructure, could be replaced by a different type of system in the future. At present, the Federal Reserve’s Boston and New York branches have set in motion two distinct prototypes for central bank digital currencies (CBDCs) — Project Cedar and Project Hamilton.

Why you should fear #FedNow

America is developing a digital dollar. #CBDC

Project Cedar is a collaboration between several powerful organizations, including the New York Fed… the Bank for International Settlements… Citigroup… Wells Fargo… Mastercard… and SWIFT.

Its goal…

— Stephen McBride (@DisruptionHedge) June 26, 2023

Fednow and Ripple’s Role Discussed as Fed Discloses ‘Features and Enhancements Will Be Added in Future’

The list of prominent financial players embracing the Fednow system includes ACI Worldwide, Finzly, Jack Henry & Associates, Bryant Bank, Hawaiiusa Federal Credit Union, BMO Harris Bank, BNY Mellon, Bridge Community Bank, Citizens National Bank, Citi, Finastra, First Bank, Atlantic Community Bankers’ Bank, Capital One Financial, JP Morgan Chase, Wells Fargo, and many others. Nearly 60 firms have received certification to utilize the Fednow instant payments system. All these firms are seamlessly connected to the extensive network of 4,844 insured commercial banks in the United States and can access the Federal Reserve’s overnight banking rates.

For those wanting to know “what about price” for #XRP and #FEDNOW usage, read my thread from a year ago.

The start of FEDNOW will not directly affect the price.

But, something else will 👇👀 https://t.co/FwAiGVlPSH

— Chad Steingraber (@ChadSteingraber) June 29, 2023

Although the current implementation of the Fednow system does not utilize blockchain technology, there is speculation regarding the potential integration of XRP or a stablecoin in the future. Some enthusiasts have drawn attention to Federal Reserve Chair Jerome Powell’s remarks on a central bank digital currency (CBDC) during his testimony before Congress on June 21. Powell stated, “We would not support a central bank digital currency for individuals. If we did have a CBDC, it would be intermediated by banks.” Supporters of XRP believe that Ripple Labs or XRP itself may be involved in some capacity, while others go as far as to suggest potential long-term impacts on XRP’s value.

Furthermore, the “Economic Report of the President” from the White House emphasizes that the Fednow system has “the potential to realize many of the benefits that crypto asset developers have promised.” In mid-March, the Fed explained that changes could be added to the Fednow system at any time. “More features and enhancements will be added in future releases to continue supporting safety, resiliency and innovation in the industry as the Fednow network expands in the coming years,” the U.S. central bank disclosed.

What do you think about the U.S. central bank’s Fednow project and the coming July 1 launch? Share your thoughts and opinions about this subject in the comments section below.