Lido, Coinbase, and Rocket Pool Corner 89% of Ethereum’s Booming $20 Billion Liquid Staking Market

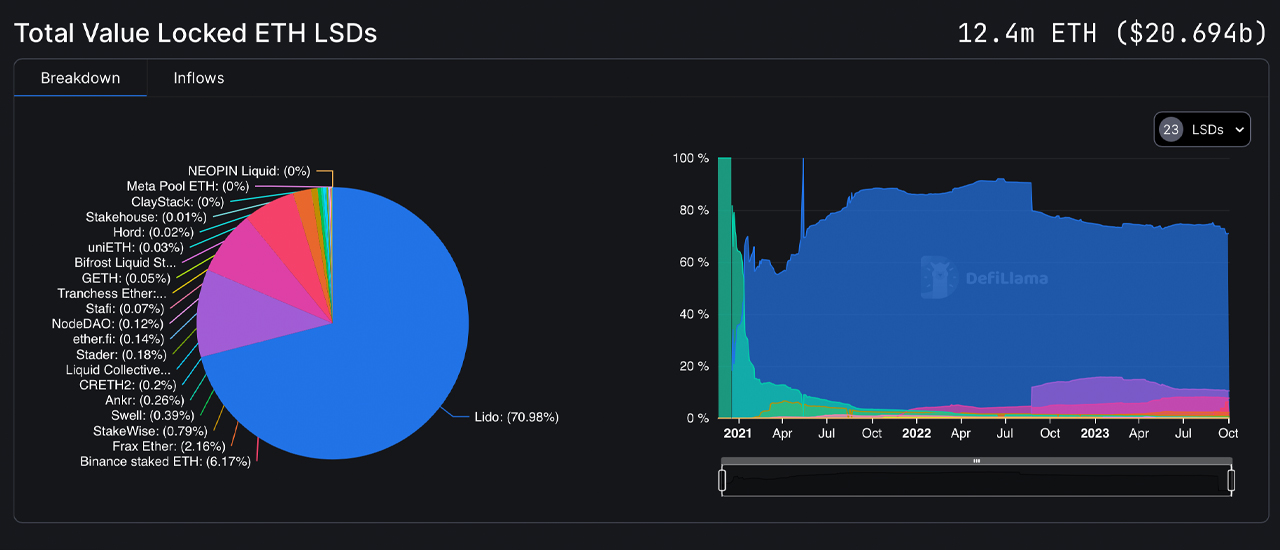

Since 2020, applications for liquid staking on the Ethereum blockchain have seen steady growth, and as of the first week of October 2023, a total of 23 liquid staking derivatives (LSD) platforms hold 12.4 million ether, valued at over $20 billion. Currently, the top three LSD protocols hold sway over 11.041 million ETH, accounting for a substantial 89.18% share of the overall ether locked.

3 LSDs With 11 Million Ether

Roughly a week ago, the number of ethereum (ETH) held by liquid staking derivatives (LSD) protocols surpassed the 12 million mark, with an addition of 370,000 ETH in five days. Essentially, an LSD is a decentralized platform that allows users to stake their ETH in a liquid form, enabling them to maintain flexibility and liquidity while earning rewards simultaneously.

Currently, the top three protocols — Lido, Rocket Pool, and Coinbase’s Wrapped ETH platform — command 89.18% of the entire market share of LSD tokens. Lido Finance, established in 2020, is the largest LSD holder of ethereum (ETH) with 8.79 million ETH held.

This indicates that the $14.55 billion in ether held by Lido represents 70.96% of the entire market share of LSDs. In exchange for ETH, individuals receive Lido’s staked ether, or STETH. The current market valuation places STETH among the top ten tokens when positioned alongside the largest market caps.

There are 269,080 unique addresses holding STETH, and the token has recorded around 1.15 million transfers. As of now, the circulating supply of STETH stands at 8,790,000, with the top 100 holders collectively owning 69.26% (6,088,042.02 tokens) of the STETH supply. A study published by Coingecko on September 29, 2023, shows STETH has an average yield of 4.6%.

Coinbase’s Wrapped ETH platform ranks as the second largest LSD project and currently holds around 1.3 million ethereum valued at $2.26 billion. At present, there’s a circulating supply of 1,297,211 CBETH tokens held among 40,653 unique addresses. Since the project’s inception, CBETH has recorded 210,532 transactions.

The distribution of the Coinbase LSD token is somewhat more concentrated than that of STETH, as the top 100 holders collectively own 96.43% (1,250,865.13 tokens) of the circulating CBETH. In August 2023, the average yield of CBETH remained above 3% and has surpassed 4% on several occasions over the past year.

The third largest ethereum (ETH) holder among the top LSDs is Rocket Pool, with a cache of 951,264 ETH. Rocket Pool’s market share in the LSD market stands at 7.68%, while Coinbase’s is at 10.48%. When individuals exchange ETH using Rocket Pool, they receive a token termed RETH, and currently, there is a total supply of 529,872 RETH.

The LSD token RETH has 18,784 holders and has recorded 197,928 transactions. The top 100 holders collectively own 67.91% (359,823.38 tokens) of the RETH supply. Below Lido, Coinbase, and Rocket Pool are LSDs such as Binance Staked Ether, Frax Staked Ether, and Stakewise, with each one holding a formidable amount of ethereum.

Liquid staking derivatives persist in carving their niche within decentralized finance (defi), affording users the avenue to stake (earn) devoid of any minimum prerequisites. The same research conducted by Coingecko reveals that the top eight LSDs have produced an average yield of 4.4% annual percentage yield (APY) since January 2022.

LSDs encounter a fair share of critics, many of whom argue that the notion fosters a centralization of the supply and validators. Conversely, some enthusiasts advocate that LSDs bolster the decentralization and security of Ethereum (and other chains) by amplifying the diversity within the validator set.

What do you think about the top three LSD platforms and their associated tokens? Share your thoughts and opinions about this subject in the comments section below.