Hidden In Plain Sight: Why 85% Of Q3’s Crypto Biggest Scams Went Undetected

Blockchain security auditor Hacken recently revealed concerning insights into the proliferation of ‘rug pulls, a malicious tactic aimed at stealing funds from crypto users, and how they accounted for the majority of Q3 crypto scams.

Rug Pulls: The Prevalent Crypto Scourge

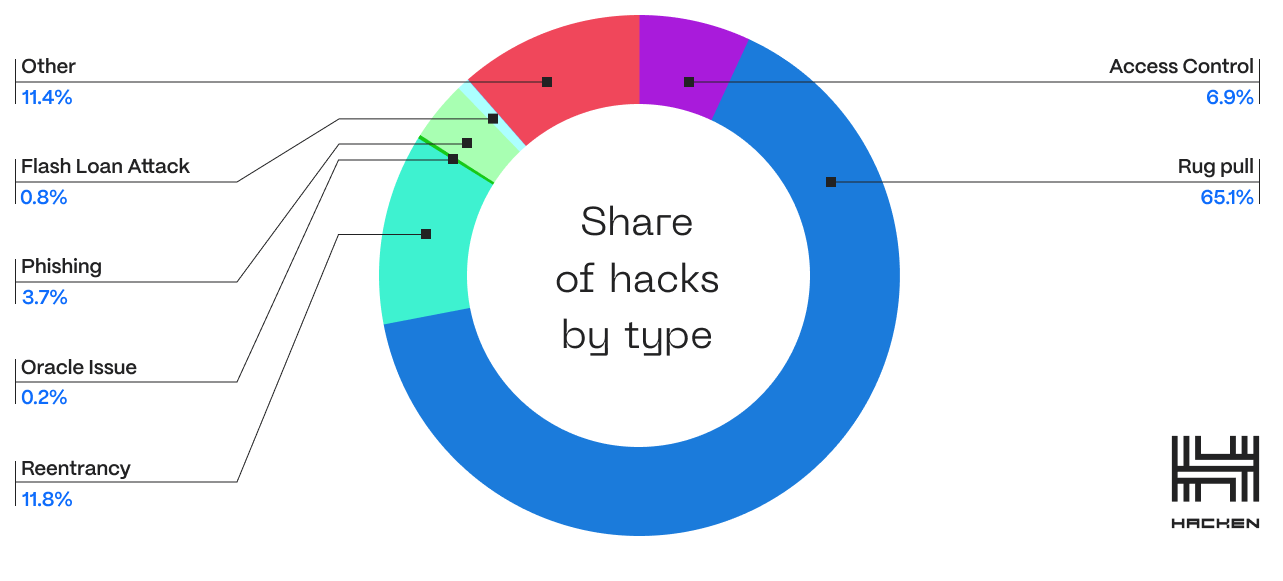

‘Rug pulls,’ as they are colloquially referred to, are a specific type of exit scam. Project teams artificially inflate the value of their token before abruptly removing all liquidity, leaving investors in the lurch. Disturbingly, this method made up roughly 65.1% of all Q3 hacks, Hacken’s research showed.

According to the report, a core reason behind such high numbers is the ease with which these scams can be concocted. With “token factories” churning out fraudulent tokens en masse, this menace seems poised to continue unless drastic measures are undertaken, the report added.

Despite their high frequency, rug pulls are not impenetrable fortresses. Hacken’s data suggests these scams are among the simplest to detect and prevent.

Hacken disclosed that a key factor in the assessment of any crypto project’s legitimacy is the presence of a third-party audit. Interestingly, only 12 out of the 78 rug pulls analyzed by Hacken in Q3 reported undergoing any form of audit.

The Double-Edged Sword Of Audits

However, an audit is not a one-size-fits-all remedy. The mere presence of an audit does not automatically vouchsafe a project’s credibility. As Hacken pointed out, a project might have undergone an audit but ended up with a “poor score.” Hacken noted: “Yet, users overlook this and consider the mere fact that the project was audited as sufficient.”

Dyma Budorin, Hacken’s co-founder and CEO, also shed light on why some investors might turn a blind eye to such glaring red flags. According to the CEO, the rapid success of certain tokens, like Pepe and Shiba Inu, which transformed meager investments into substantial returns, fuels the phenomenon known as the Fear of Missing Out (FOMO).

Budorin notes that this rush for potential quick profits leads many to overlook evident risks and jump headlong into dicey investments. Budorin added:

Scammers are well aware of this, and they are very good at mimicking successful projects. Scammers frequently refer to thriving projects, intensifying the FOMO on the next big opportunity.

Budorin also touched upon the simplicity of the investment process in the crypto world, which often involves just a “few clicks.” The CEO noted this ease can inadvertently facilitate impulsive decisions, further compounding the problem.

Featured image from iStock, Chart from TradingView