Glassnode Data Shows Bitcoin Supply Less Liquid Than Ever Despite Market Gains

The scarcity of the bitcoin supply has tightened, as revealed by the recent Glassnode study on onchain activities. Observations show that the inactivity of coins is touching both multi-year and unprecedented peaks, despite a substantial uptick in bitcoin’s value throughout the current year.

Bitcoin’s Tightening Supply Defies Price Rally, Reveals Glassnode Study

Reflecting on the trend over the last year, BTC has surged by 71% and has marked a 114% increase from the start of the year to date. Glassnode’s latest report indicates that despite these surges in price, the availability of bitcoin remains limited, dominated by steadfast holders.

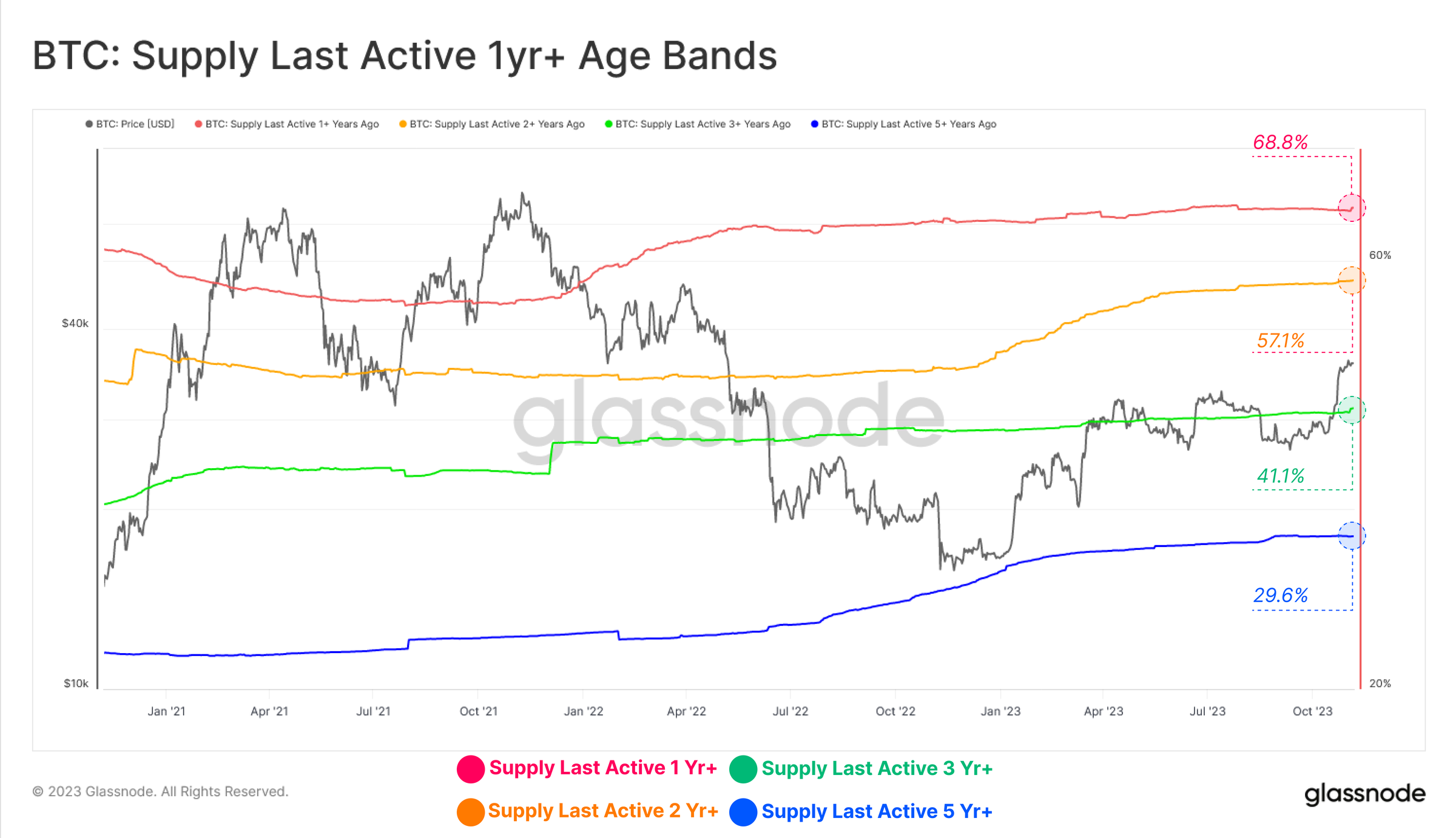

Taking a closer look, the onchain report shows that a share of bitcoin (BTC) that hasn’t moved in over a year stands at 68.8%, and the non-liquid supply index has risen to a record-breaking 15.4 million BTC. The Glassnode team has pinpointed that the cache of bitcoin held by long-term investors is approaching record levels, while the supply by short-term investors has plummeted to unprecedented lows.

Glassnode details that the growing gap indicates a solidifying of supply, as current investors are showing reluctance to part with their holdings. Since July 2022, the disparity between the supplies held by long-standing and recent investors has expanded, reaching new heights and underscoring the stark contrast between dormant and circulating supplies.

Moreover, the newly introduced Glassnode metric called the Activity-to-Vaulting Ratio has been on a decline since June 2021, with a notable dip in the trajectory post-June 2022. According to Glassnode, this shift signifies the waning of the 2021-22 cycle’s market “exuberance.”

The researcher’s analysis of spending patterns reveals a trend of investor accumulation and retention, as opposed to active trading. The post-rally Sell-Side Risk Ratio for short-term holders soared, signaling some profit-taking in the short run, while this metric for long-term holders remains notably low in a historical context.

Glassnode’s evaluation of wallet activity notes striking contributions to wallet sizes across the board, indicating a boost in investor confidence. The “Shrimps” and “Crabs” are buying into bitcoin en masse, having absorbed 92% of the bitcoin mined since May 2022. “Shrimps” hold less than one bitcoin, “Crabs” command 1-10 BTC, and “Fish” hold anywhere between 10-100 BTC.

Concluding their observations, Glassnode analysts assert, “The bitcoin supply is historically tight with many supply metrics describing ‘coin inactivity’ reaching multi-year, and even all-time highs. This suggests that the [bitcoin] supply is extremely tightly held, which is impressive given the strong price performance [year-to-date].”

What do you think about Glassnode’s report concerning the tightening bitcoin supply? Share your thoughts and opinions about this subject in the comments section below.