Bitcoin Price Moving Past $42,000 Could Be Start of Mega Bull Run

Coinspeaker

Bitcoin Price Moving Past $42,000 Could Be Start of Mega Bull Run

On Monday, December 4, the world’s largest cryptocurrency Bitcoin (BTC) delivered a bullish rally shooting past $42,000. The recent bullishness around Bitcoin revolves around the expectations of a Bitcoin ETF approval in early January 2024.

Bitcoin surging past $42,000 is viewed as the beginning of a new crypto supercycle, with enthusiasts predicting it could surpass $500,000. The digital assets community is brimming with optimism as Bitcoin records its third consecutive month of gains, rising 11% in December.

The unexpected revival in 2023, with a more than 150% increase, is fueled by anticipation of a potential approval for a Bitcoin exchange-traded fund in the US. Coinbase CEO Brian Armstrong even suggests Bitcoin could be key to extending Western civilization. Predictions for Bitcoin’s future range from $50,000 to over $530,000, reports Bloomberg.

Tuesday’s positive momentum for Bitcoin also influenced various crypto-related stocks, including notable names like Coinbase Global Inc (NASDAQ: COIN), MicroStrategy Inc (NASDAQ: MSTR), and Marathon Digital Holdings Inc (NASDAQ: MARA).

Coinbase shares, in particular, saw a robust increase of 5.5% on Monday, building on the 7.3% gain recorded on Friday. Notably, COIN stock has soared an impressive 299% since the beginning of the year.

MicroStrategy, a company with substantial investments in Bitcoin, also experienced a notable uptick of 6.7% on Monday, contributing to its overall gain of approximately 298% in the year 2023. The cryptocurrency mining sector also showed strength during this rally, as Marathon Digital surged by 8.5% on Monday, and competitor Riot Platforms Inc (NASDAQ: RIOT) saw an even more significant spike of 10.2%.

Bitcoin Decoupling from Equities

As the Bitcoin price hits a 19-month high, it has been strongly decoupling from equities. Bitcoin surged by 5.8% on Monday, surpassing $42,000 and maintaining close levels on Tuesday during Asian trading. This gain contrasts with losses seen in global stocks and bonds this week.

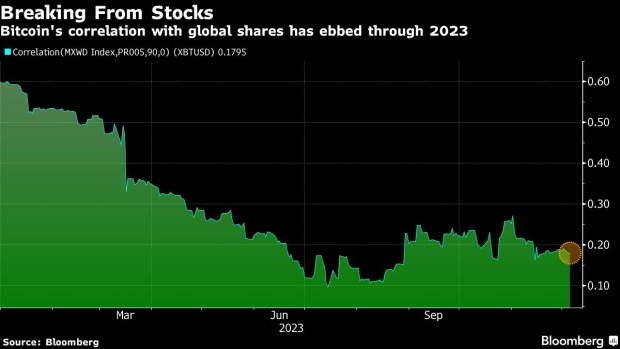

Analysts note a low correlation between cryptocurrency and traditional assets, citing factors like the anticipation of the U.S. approving its first spot Bitcoin exchange-traded funds. Bitcoin’s correlations with stocks and gold have diminished in 2023, with a 90-day correlation coefficient dropping to 0.18 from 0.60 for stocks and to near zero from 0.36 for gold. This signifies a changing relationship between cryptocurrencies and traditional financial assets.

-

Photo: Bloomberg

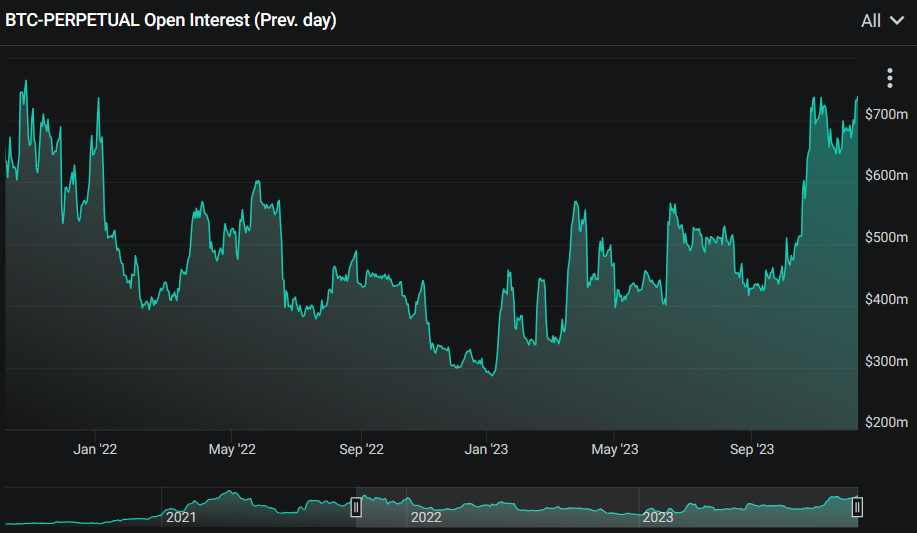

- The open interest in bitcoin perpetual futures on the Deribit derivatives exchange has surged to a yearly high of $740 million, reaching a level not witnessed since November 2021 when bitcoin set its all-time high of over $68,000.

Commenting on this development, Justin d’Anethan, the Head of Business Development for APAC at Keyrock, highlighted that the current premium on CME bitcoin futures contracts serves as an additional indicator of heightened institutional involvement.

D’Anethan noted:

“One can’t help but notice a healthy futures premium on CME contracts, hinting at some large sophisticated players wanting BTC exposure.”

This observation underscores the increasing interest and participation of institutional investors in the cryptocurrency market.

Bitcoin Price Moving Past $42,000 Could Be Start of Mega Bull Run