Spot Bitcoin ETF Is Coming, MicroStrategy May Suffer: Here’s Why

A value investor, Mike Alfred, predicts that MicroStrategy, the public business intelligence company, will suffer once a spot in the Bitcoin ETF is approved in the United States. In a post on X, Alfred also noted that MicroStrategy is down 5% and is trading as “if the market expects the spot ETFs to be approved soon.”

MicroStrategy’s Premium Will Fall, MSTR Prices Will Drop

Despite the expected reduction in MicroStrategy’s premium, Alfred believes its stock price, currently trading at around $600, may recover steadily in the next bull run.

Looking at the MSTR stock in the daily chart, prices appear to be topping out. Share prices rose to as high as $717 in the first week of January before dropping 16% to spot rates. The sell-off continues when writing with critical primary support at the $475 and $500 zone.

Analysts now say a regulated spot Bitcoin ETF will see more institutions opting for this product instead of shadowing Bitcoin via the MSTR stock. As a result, the demand for MSTR shares will likely contract.

For this reason, the MSTR sell-off might continue in the short term. However, as Alfred predicts, share prices will recover in later stages and rally to $1,500.

Will A Spot Bitcoin ETF Lift BTC To $100,000?

Alfred continued that the MSTR recovery will come as Bitcoin floats to set record highs above $100,000. So far, as the community closely monitors the United States Securities and Exchange Commission (SEC) and whether it will approve the first spot Bitcoin ETF, BTC prices are firm, reaching $47,200 on January 8.

Bitcoin bulls believe prices may rally to as high as $69,000, last registered in November 2021, once the coveted derivative product hits the market.

Despite the MSTR price falling, some are confident that buying the stock is a better alternative to a spot Bitcoin ETF. MicroStrategy has indirectly and actively increased shareholders’ exposure to Bitcoin through its accumulation strategy. All this is without charging a management fee, benefiting clients, including institutions, who considered the MSTR stock a “shadow spot Bitcoin ETF.”

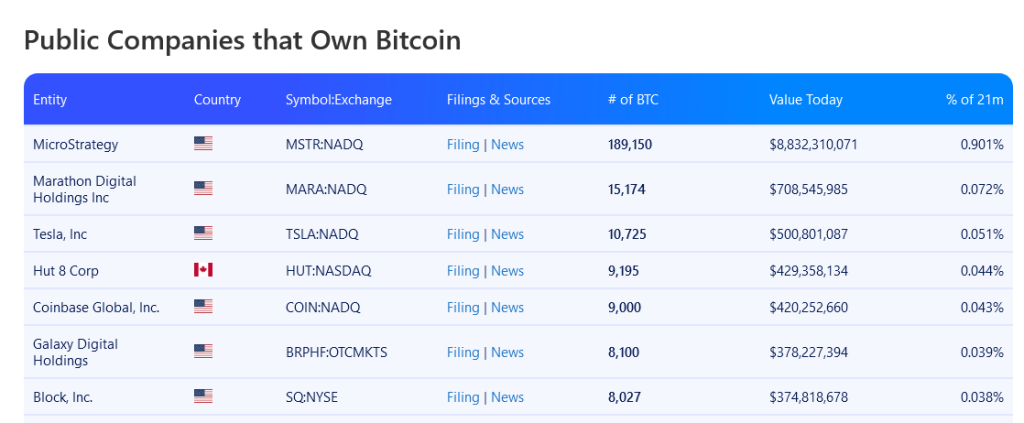

To illustrate, Bitcoin Treasuries data on January 9 reveals that MicroStrategy holds 189,150 BTC worth over $8.8 billion at spot rates in its balance sheet. This figure means it leads public companies who own Bitcoin.